CHAPTER 4. THE ECONOMIC CONSISTENCY OF THE GREAT RELIGIONS AND ITS EVOLUTION

4.1 The General Economic Consistency Ranking of the Great Religions

In order to find the level of economic consistency of the great religions I was concerned with in this research, I employed economic consistency criteria. These are nothing more than dogma components to which I attached specific logics for ultimately decoding the preference for the megagood absolute wealth. I employed ten economic consistency criteria (I could have employed more, but there were not enough data).

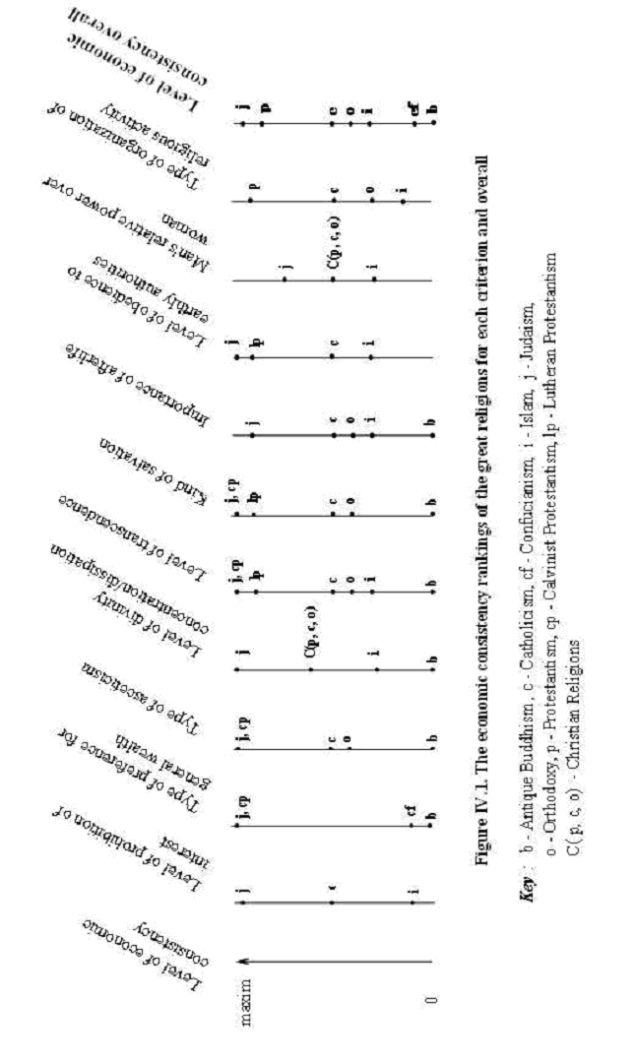

The overall economic consistency ranking for the great religions and one religious substitute covered by my study, in descending order, is the following: Judaism, Protestantism (Calvinism, Lutheranism), Catholicism, Orthodoxy, Islam, Confucianism, Buddhism. The overall ranking as well as the rankings for each criterion are depicted in Figure 16.

It was not possible to decode and, consequently, rank all religions for each criterion. A comprehensive consistency ranking of religions was made by employing transitivity. Transitivity was possible because within the general power model all religious values and rules are rankings of the megagoods (in terms of preferences or opportunity costs) and each religion is a system and, as such, should have a unique ranking of the megagoods. This logical consequence was proved true by the finding that none of the rankings of various criteria contradicted any of the other rankings.

For two criteria—level of divinity concentration/dissipation and the power of man over woman—the Christian religions are ranked as a group: C(p,c,o). For three of the criteria—type of preference for general wealth, type of asceticism and the level of transcendence—Judaism and Calvinist Protestantism seem to rank equally. However, when the ranking included Lutheran Protestantism, this was ranked after Judaism, which makes it safe to say that, as a whole, Protestantism has a lower economic consistency relative to Judaism.

My analysis confirms Weber’s observations about Protestants and Sombart’s observations about Jews. From the very beginning Judaism has known an economic consistency level which the other religions, except Calvinism, have not known yet. Judaism proves to be nothing more than encoding, by employing religious terms, the social system of liberty or of the institutions and values which are most consistent with economic performance.

4.2. The Evolution of the Economic Consistency of the Great Religions

The internal evolution of the six great religions depicted graphically in figures 9 to 12 leads to a conclusion which the general power paradigm generates and which I previously revealed in my book The Economic Theory of Cultures and Institutions (2007): All cultures have a unidirectional movement toward an ever greater weight for the megagood absolute wealth. All six of the great religions, except Judaism (which constitutes an exception only regarding schismatic evolution), have recorded schisms following this pattern: New dogmatic components or religions with higher economic consistency separated out from the initial dogmatic component; in the course of time these new components became dominant components. Catholicism and later Protestantism separated out from antique Christianity, which was carried on by Orthodoxy. Mahayana separated out from antique Buddhism, which was carried on by Hinayana. Sunni Islam separated out from the initial Islam, which fundamentally was carried on by Shi’a Islam.

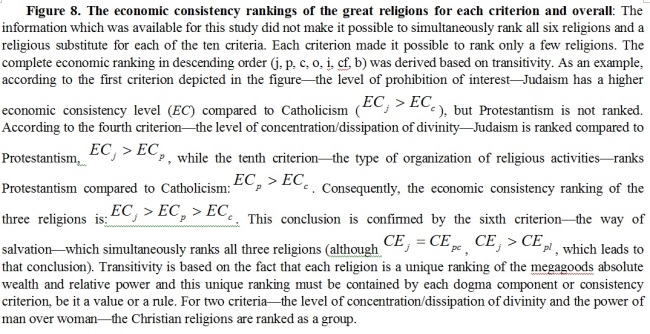

Figure 9. The evolution of the economic consistency of Judaism: From its very beginning Judaism has known a level of economic consistency which the other religions have not known yet. During Biblical times (until the Second Temple, 535 BCE), Judaism was affected by Canaanite influences (meaning it contained idolatry components), which equaled to institutionalization of some relative power supply. Beginning with the period of the Second Temple (after 535 BCE), the economic consistency level was higher due to King Josiah’s reforms which were initiated almost a century earlier, and the emergence of Rabbinic Judaism elements. In the period that followed the last destruction of the Temple (70 CE), the economic consistency level increased again, coming very close to the highest possible level. This was due to due to passing to full Rabbinic Judaism and the disappearance of the sacerdotal function. What kept Judaism from reaching the highest possible consistency level was its adoption of the idea of afterlife.

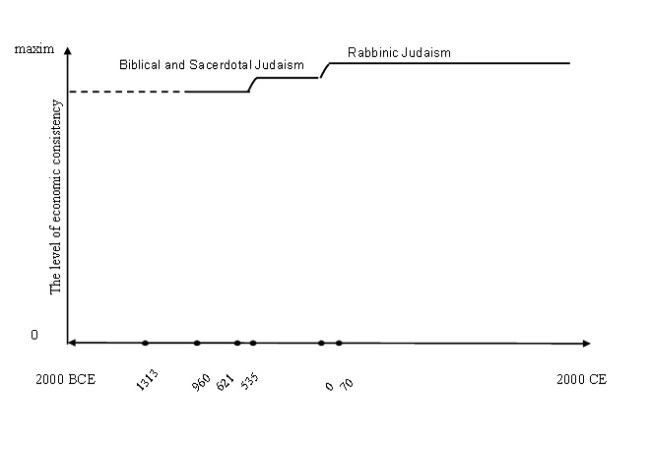

Figure 10. The evolution of the economic consistency of Christianity: The first significant increase of the economic consistency level of Christianity occurred about one millennium after its birth, and it is singled out by the Great Schism of 1054 when Catholicism separated from antique Christianity. However, the great leap to a very high economic consistency level was recorded half a millennium later by the separation first of Lutheran Protestantism (in 1517 when Luther published his 95 theses) and especially of Calvinist Protestantism (in 1536 when Calvin published his work Institutes of Christian Religion). This last version of Protestantism brings part of Christianity very close to the economic consistency level of Rabbinic Judaism, or close to the maximum possible level.

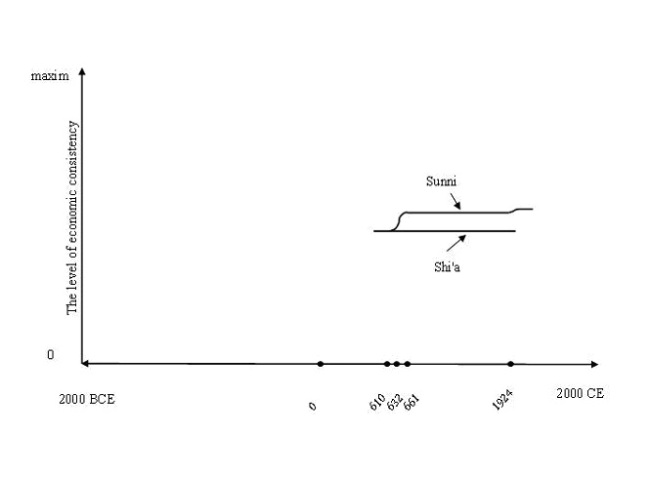

Figure 11. The evolution of the economic consistency of Islam: Shortly after the exodus to Medina, Muhammad became the political and religious leader of the Islamic world. As the absolute religious leader he was also the only interceder in the relationship with divinity having de facto capacity to form the dogma. This extraordinary power is preserved by Shi’a Islam through the position of Imam which is assisted by an ecclesiastical hierarchy. It could be said that overall, except for a short period between Muhammad’s death (632) and the Great Islamic Schism (661), Shi’a Islam almost preserved the power concentration and, consequently, the consistency level that existed in the course of Muhammad’s life. As such, Sunni Islam moves this religion toward a greater consistency level because it decreased the relative power supply (or increased its opportunity cost) by introducing the position of caliph. The caliph retained Muhammad’s positions as religious and political leader but lacked the position of the unique interceder with the divinity or the capacity to shape the dogma. Besides, the caliph was elected by the community. A shift toward an increase of the economic consistency level, although not great, occurred following the disappearance of the caliphate in 1924.

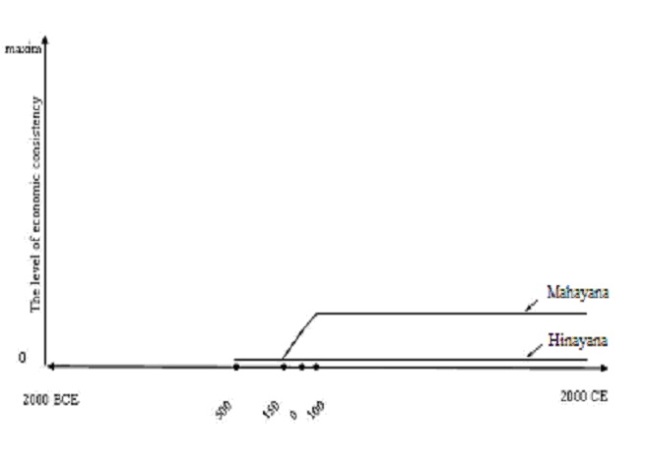

Figure 12. The evolution of the economic consistency of Buddhism: From its very beginning, Buddhism created an extraordinary supply of relative power and, consequently, achieved the lowest economic consistency level, indeed a level very close to zero. This was done by limiting salvation to a small group of very able monks and conceiving of Nirvana as a state beyond the paradise of gods. The Hinayana component preserved the initial Buddhism. The separation of Mahayana between 150 BCE and 100 CE increased the consistency level of Buddhism: Buddha and the other interceders could help others less able to get salvation. This democratization of salvation decreased the supply of relative power and as such increased its opportunity cost. However, even if only Mahayana is taken into account, Buddhism records a level of economic consistency lower than Judaism, lower than any of the Christian religions and lower than the consistency level of Islam. This is due to its rejection of the idea of divine transcendence.

This unidirectional movement of cultures, which is confirmed by the transformation of religions over the course of time—from cultures centered on the megagood relative power to cultures centered on the megagood absolute wealth, is rejected by many scholars. However, these scholars ground their rejection on a fundamental confusion. In a way similar to Fukuyama’s (who initially defended the unidirectional movement in 1992, but later rejected it in 2004), many tried to check this possible evolution toward the social systems of liberty based only on the presence of the political system of liberal democracy[1].

Such a method of checking up does not confirm the unidirectional movement because many countries of the world are politically organized based on dictatorial and/or authoritarian systems. The fundamental error consists of not taking into account the evolution of the other institutions which signal cultural evolution, especially the institution of free markets. Almost all of the present authoritarian political systems and the greatest dictatorial political system (the Chinese one) employ on a sizable scale the institution of free market which is in fact the institution of liberty in the economic field and which, as such, doubtlessly signals the aforementioned unidirectional cultural movement.

Another great confusion is relative to the time span of evolution and prediction. Cultural values were shaped during millennia and the duration of their transformation should be comparable. Consequently, we should not expect cultures centered on the megagood of absolute wealth to prevail fully in time spans of decades or even centuries. What we should look for is only the direction of evolution. In other words, the unidirectional movement of cultures can only be asymptotical to a time coordinate.

A great part of the world has already evolved toward a culture centered on the megagood of absolute wealth through simultaneously adopting both liberal democratic systems and the institution of free market. Other countries have evolved in the same direction by partially adopting the same values or, more exactly, adopting the institutional setting of free markets. Taking into account that in the long run it is not possible for any society to function by simultaneously employing different systems of values in various sectors, the presence of the institution of free market in the economic sector will trigger an evolution toward the same values in the other sectors. These changes might not be spectacular in the short run, but there is certainty relative to their nature.

In the end, I would like to answer a question which might very likely be posed by many readers: If religions are so important to the economic performance of various countries, why have countries with very different religions performed economically equally? Why, for instance, have Sweden and Japan had comparable economic performances (at least in the course of their modern history), when it is well known that Sweden is a Protestant country while Japan has been dominated by religions having much lower levels of economic consistency (Shinto, Buddhism, Confucianism)? The answer is simple: The economic institutions which account for the good economic performance of the countries having religions with much lower consistency levels than Protestantism—free markets—are not of a similar nature with that of the local religions, but rather are similar with the nature of Protestantism. Those institutions were either freely adopted (as in the case of China) or were imposed by force (as in the case of Japan). The Protestant religion and the institution of free market are simply descriptions in different terminology of the values and institutions inspired by the same Western culture—which has a high or exclusive preference for the megagood absolute wealth.

[1] Fukuyama (1992) rightly identified the unidirectional movement of cultures, but his argument and mainly his way of checking up were wrong (Fudulu, 2007). Testing the hypothesis based only on the presence of institutions of liberal democracy and ignoring the institutional setting of free markets (which equally signal the evolution toward liberty, even if they are employed by authoritarian political regimes), forced him to later retract (Fukuyama, 2004) and accept its falseness.

Posted by paulfudulu

Posted by paulfudulu